Cyber security is an increasingly important issue. From online ordering, banking, and bill pay to online tax documents and loan applications, the internet has become our go-to for conveniently sending and receiving sensitive information. That’s before we even consider the sheer number of internet connected devices we use on a daily basis.

With our growing reliance on all-things on-line, it’s not hard to see why cyber security has become a key issue. And according to a recent study by Norton, it’s a key issue most of us are failing at. Miserably. So today we’re taking a look at their 2017 Cyber Security Insights Report to explore where exactly most people go wrong and how to do better online.

Our Biggest Problem: Overconfidence

According to Norton’s study, consumers worldwide are overconfident in online security. They estimate that 978 million people in 20 countries were affected by cybercrime in 2017. 44% of the adult population was impacted by cybercrime in the last 12 months.

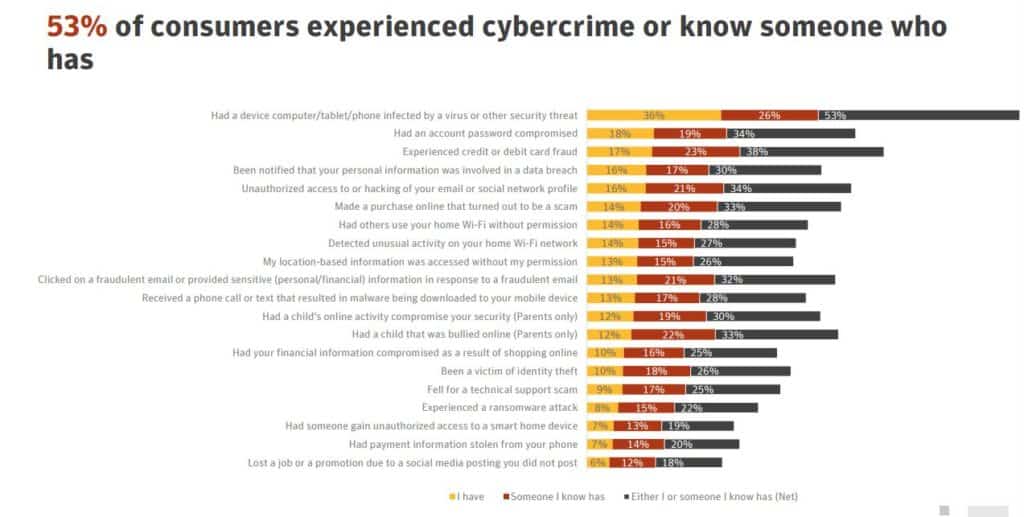

These breaches occurred in a variety of ways (see below). The top hacks came in the form of an infected device, debit or credit card fraud, and account passwords being compromised. The result? Norton estimates that victims of cybercrime globally lost $172 billion.

Despite the scale of these losses, many consumers fail to take even the most basic precautions—particularly when it comes to passwords.

Password Failings

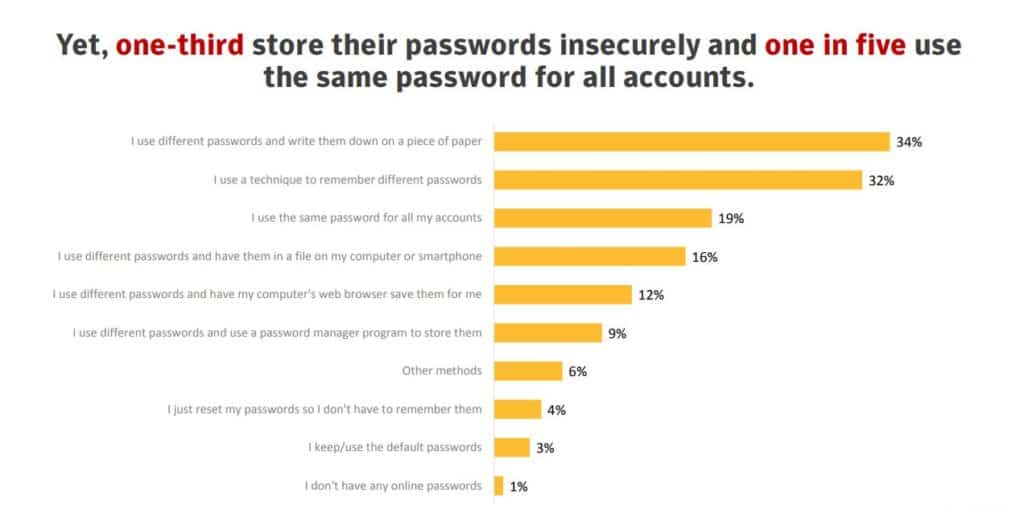

According to Norton, one in five people use the same password for all of their different accounts. Using the same password is a major problem. If any account gets compromised, all of your data is at risk. Someone unlocking your online shopping profile is a problem. That problem is exponentially worse if they can use that same password to access your bank, credit cards, credit checks, etc.

Even if you aren’t guilty of reusing the same password across all accounts, one in three people take major risks with their logins. From writing passwords down on paper to having all passwords saved insecurely on your phone, most people use unsafe methods to keep all of their online logins straight.

Another high-risk behavior is especially prevalent with millennial consumers. 63% of millennials share passwords. While sharing a Netflix login seems harmless, the more people with access to your account the more vulnerable it becomes; especially when you remember that giving someone your login means they can also access your on-file payment.

What to Do

Despite the scale of this problem, Norton has some easy-to-follow suggestions to start improving your cyber security habits.

- “Craft the perfect password:” Everyone should focus in on this, since so few of us do it right. Your password shouldn’t be tied to publicly available information. Use phrases that incorporate an easy-to-remember string of words that’s hard for anyone else to crack. The longer your password, the better. You should also consider two-factor authentication for an additional layer of security where available.

- “Know the ins and out of public Wi-Fi networks:” Basically, don’t put any personal information out on unprotected public Wi-Fi. Avoid doing anything that involves sharing your info (paying bills, logging in to social media accounts, paying for anything with a credit card, etc.) on public Wi-Fi.

- “Don’t keep a (dis)connected home:” Any time you install a new network-connected device, (router, smart thermostat, game system, etc.) make sure you change the default password. If you buy a connected device but don’t plan to use the online feature disable or protect remote access. You should also protect all wireless connections with strong Wi-Fi encryption, so no one can easily access the data traveling between devices.

- “Don’t go on a phishing expedition:” NEVER open unsolicited messages or attachments or click on random links from people you don’t know. Even if it’s someone you know, don’t click or open anything that seems at all suspicious. It’s not worth the risk.

Bottom Line

In one way or another, we all could stand to take a little extra time to protect ourselves online. The internet has changed almost every aspect of our lives—particularly how we access and share information. While this change has added speed and convenience to many industries, it comes with a heightened risk that shouldn’t be taken lightly.

When it comes to your business, this risk becomes even more crucial. Payments processing is an area that is particularly crucial. Which is why you need a processor that protects you, your business, and your customers from any threats that come your way. Contacts us today to learn about why processing with Pineapple is the safest and smartest choice you can make for your company.